Thinking about taking a job at a small company? Don’t expect a good retirement plan.

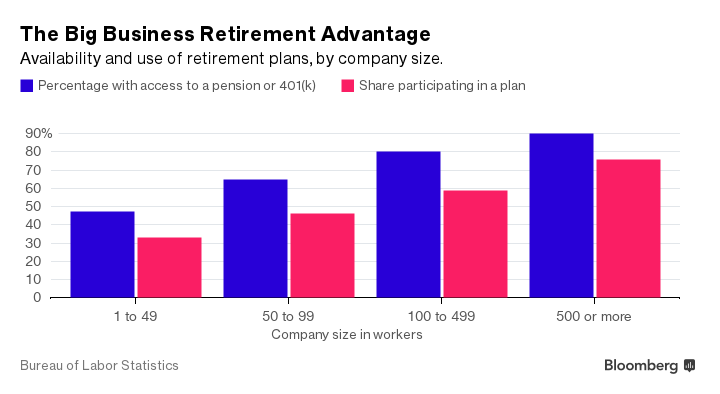

At companies with fewer than 50 workers, not even half the employees have access to a 401(k) or pension, according to the Bureau of Labor Statistics. At companies with 500 workers or more, 90 percent of employees have access to a retirement plan.

This gives large corporations a huge advantage in hiring talented people, and it leaves millions of Americans without an easy way to save for their futures. Companies with fewer than 100 workers employ 36 percent of the U.S. workforce, or about 42 million people.

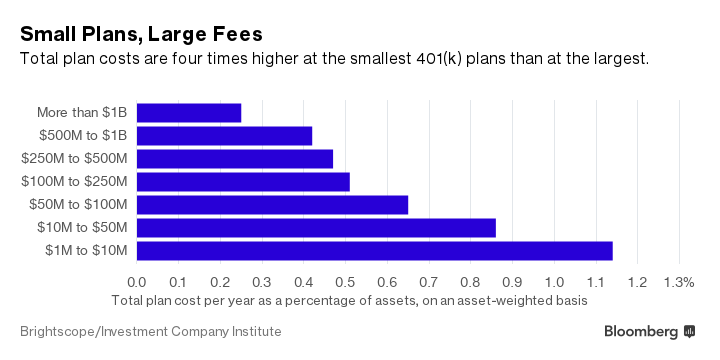

Even when small companies do have a retirement plan, it is likely to be astronomically more expensive than those offered by large companies. These high fees eat away at returns, making saving for retirement far more difficult than it needs to be.

Lawmakers in Washington and in several states are exploring ways to make it easier for more Americans to save for retirement. They’re especially focused on employees of smaller companies, who — along with part-timers — are the least likely to get a 401(k) or pension. Small-business owners aren’t enthusiastic about all these policy proposals, according to a new survey by the Pew Charitable Trusts, but most recognize the retirement problem they face.

The smaller a business is, the less time and money it usually has the luxury of spending on a retirement plan. Small-business revenues tend to be unpredictable, making it difficult to commit to matching 401(k) contributions every year, said Larry Sher, an actuary who helps design retirement plans as a partner at October Three Consulting. Even when small companies have the money, they might not have a staff member who knows how to set up and administer a retirement plan properly.

Then there’s the cost of hiring an outside firm to set up and administer a 401(k) plan. These costs can be considerable when are few employees to share the burden. While some low-cost, no-frills 401(k) plans are now available to small businesses, many instead go through local financial advisers who charge hefty fees.

It’s a lot easier to just skip offering a 401(k). Cost was the main reason owners of small and medium-size businesses didn’t offer a retirement plan, Pew found in its survey, followed by worries about administering the plans.

Five states are in the midst of shaping bold plans to change all this. California, Maryland, Oregon, Illinois and Connecticut are all setting up portable individual retirement accounts that can follow workers through their careers. Each state is requiring employers either to offer a retirement plan or to sign workers up for state-run, automatic IRAs. In California, for example, the mandate will eventually apply to all companies with five or more employees.

The Pew Charitable Trusts asked business owners what they think, surveying more than 1,600 companies with from five to 250 employees. The majority liked the general idea of an auto-IRA plan, with 27 percent strongly supporting and 59 percent somewhat supporting the concept.

Still, business owners were skeptical about the government getting involved. Just 41 percent supported the federal government sponsoring auto-IRAs, with 59 percent opposed, and just 44 percent supported state government-sponsored auto-IRAs. By contrast, 82 percent liked the idea of mutual fund companies sponsoring auto-IRAs, and 72 percent favored insurance companies running the program.

It’s not clear how these business owners will feel about specific auto-IRA programs when they’re rolled out over the next few years. The auto-IRAs are technically public-private partnerships, with state governments planning to hire private investment managers to administer the accounts.

“The good news is that small-business owners are receptive to policy solutions, because they do have a problem on their hands,” says John Scott, director of Pew’s retirement savings project.

The top reason business owners said they support the auto-IRA concept was that “it would help my employees.” Poor retirement options (and no retirement options at all) cause problems in the workplace, and not just with recruiting. “If employees don’t have some money set aside, how are they going to retire?” says Sher, the actuary. Business owners tend to want an “orderly transition to retirement,” he said, one that lets older workers stop working if they want, giving employers the chance to groom younger workers for promotions.

Other ideas at the state and federal levels may appeal more to business owners than auto-IRAs do. New Jersey and Washington State are setting up retirement plan marketplaces—state-run websites on which employers could shop for lower-cost retirement plans. All but 14 percent of business owners told Pew they like this idea.

Utah Senator Orrin Hatch, the Republican chairman of the Senate Finance Committee, has proposed offering additional incentives for small businesses to set up retirement plans. He would also make it easier for employers to join so-called “multiple employer plans,” allowing businesses to join forces to share the costs of offering a plan. “I look forward to working with my fellow Finance Committee members and senate leadership on how to get these much-needed policies enacted into law,” Hatch said in a statement.

Perhaps it’s natural for business owners to prefer incentives to government mandates — and just as natural for employees to prefer the mandates. In a survey released in November by Natixis Global Asset Management, almost 80 percent of U.S. workers said employers should be required to offer retirement plans. Almost three-quarters said companies should have to make contributions to their retirement account, something no state is currently planning to require.