FEATURED STORY: Despite polls showing overwhelming public support for teaching financial literacy skills to school students, prior to the passage of AB 2927 California had no statewide requirements around financial literacy courses in schools. As a result, the infrastructure that does exist around this has largely been developed through the initiatives of a few banks and some forward-looking schools.

My senior year of high school, we were required to spend 55 minutes each day learning life skills for our impending adulthood, from sex ed to filing taxes.

At least, that’s what we were supposed to be doing. Most of my memories from that class involve doing last night’s homework, laughing at anatomical diagrams while trying not to choke on a Taco Bell burrito, clowning around with friends and, for whatever reason, watching “Happy Gilmore” on the projector while the teacher caught up on emails. Any “quizzes” or “grades” from that class were bogus, and it was a blast. But now, as a fully grown adult, I wish we had taken it more seriously.

If you are also an adult, you might relate to the sentiment that most of life’s challenges were not addressed in school. For all the hours spent learning trigonometry and the procession of King Henry VIII’s wives, very little time was spent on the basic skills we all need to succeed. I’ve wondered why that is. Is it gatekeeping? Or is it an uncomfortable subject for adults who had to learn the hard way and are still paying for their mistakes?

If you don’t have a financially literate parent to advise you, you’re starting from behind. If you want to see how hopelessly uninformed many of today’s young people are, just watch Caleb Hammer (the Millennial Dave Ramsey) try to coach Gen Z’ers out of an obscene amount of credit card debt, unintentional tax evasion or their bullish reasoning that they need a $60,000 truck.

Personal finance is a game of life-altering decisions, and it’s about time we give young Americans the full deck.

- Dakota Morlan, Managing Editor

Other stories you may have missed: Chefs, Growers and Citizen Scientists Are Embracing Mushroom Foraging and Its Culinary Potential

The farm-to-fork pipeline is well established in Sacramento — but what about forage-to-fork? We talked to some of the foragers, scientists, chefs and enthusiasts who want to see more foraging in the Capital Region.

From Baker’s Stats to Stanzas: Jim Franks’ ‘Existential Bread’ Launches in Davis

Baker and poet Jim Franks launched his experimental cookbook “Existential Bread” in Davis this week in collaboration with Student Collaborative Organic Plant Breeding Education, an interdisciplinary approach that offers a new way to consider our relationship with food and the complex processes and economics behind it.

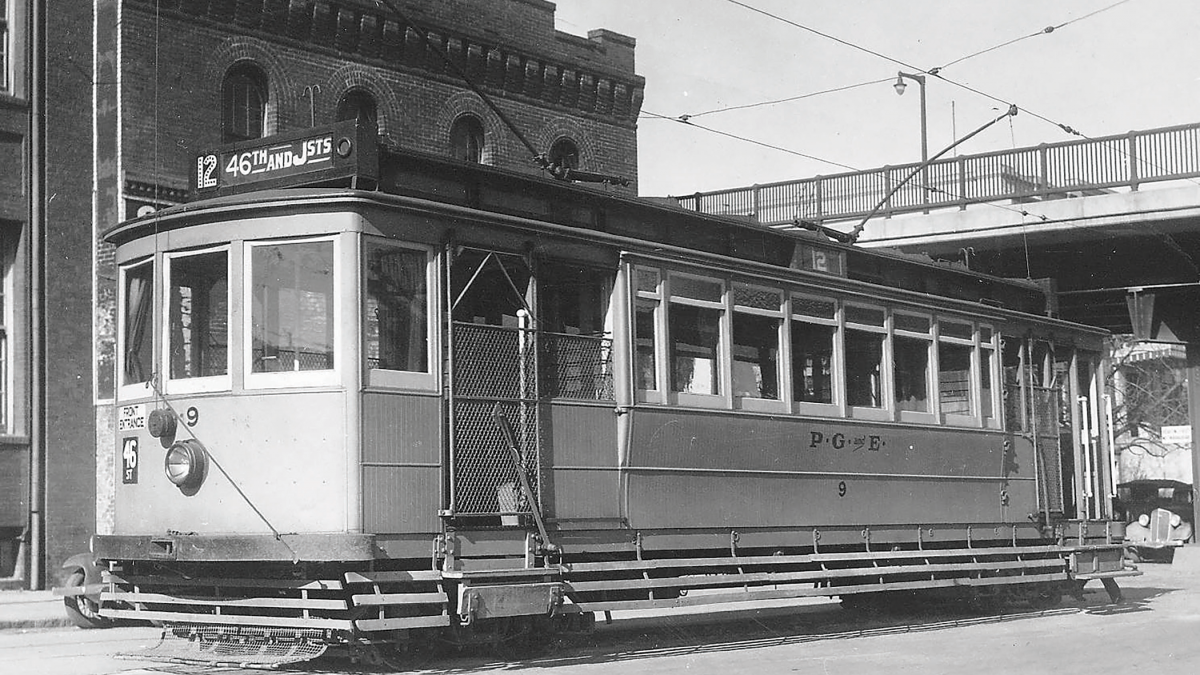

When Streetcars Roamed the Capital Region

While many of us believe that Sacramento’s light rail trains were innovative when they began tooting their way throughout the Capital Region in the 1980s, the current system is actually the reboot of a suburban trolley that slid, wended and awoke its way through the area many decades before.

Recommendations from our staff:

Judy: When “Saturday Night Live” came on the air 50 years ago it was a cultural phenomenon. It was must-see TV for a generation that stopped what they were doing at 11:30 p.m. on Saturday to watch the comedic exploits of Dan Aykroyd, John Belushi, Gilda Radner, Jane Curtin, Laraine Newman, Chevy Chase and Garrett Morris. Somehow, the show was able to continue the comedy antics for another 50 years with a new cast of characters, many of whom went on to become stars. They all came together Sunday night for a three-hour anniversary celebration. Some of the new skits were too long and didn’t hit the mark, but it was great to see all their familiar faces again and enjoy all the laughs they gave us.

Jennifer: I was enthralled by the first three episodes of the new podcast “Scam Inc” from The Economist, an amazing work of investigative journalism looking into the scam syndicates that extract millions of dollars from Americans every year. While I’d previously heard about scammers operating in India or Eastern Europe with dissatisfied but consenting employees, this project reveals that Chinese scam kingpins are trafficking workers from poor English-speaking countries like Nigeria and the Philippines and keeping them as slaves in remote compounds in Myanmar. (Unfortunately, only the first three episodes are free to listen to without an Economist subscription — and it might not be a good sales tactic to teach your listeners to keep their guard up against extortion right before trying to get them to subscribe to something!)

Odds and Ends

Don’t forget to subscribe to the magazine to stay up to date on the region’s business trends, and follow us on Instagram, Facebook, Twitter and LinkedIn for daily stories and extras.