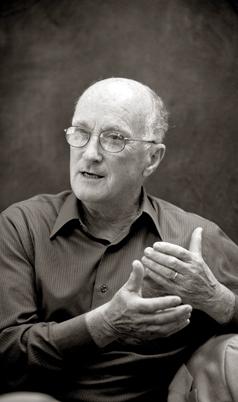

Peter Lindert is one of the preeminent voices in the “deep history” field of economics, which looks at the world economy over the scope of all human history. We recently talked with the UC Davis professor about the U.S. and global economies and the penchant for both to experience exhilarating highs and devastating lows.

Comstock’s: How would you summarize our economy in a historical context?

Lindert:We’re richer than ever before, and we live longer. Everything is better than it was any time in the deep past. Things move faster now: technology, financial instruments, etc. Mostly that’s for good, but not entirely. That’s a quick answer.

Comstock’s: The technology that we have today makes so much more of what we do instantaneous. How much has that changed the true economic balance around the world?

Lindert: Within countries, it has accelerated income growth for people at the very top; we know that. It’s happening especially in the Anglo-American, North American world, but pretty much globally as well. We have become more unequal, but so have the Chinese, radically so, compared to the days of Chairman Mao. Now between countries, it’s a more mixed picture because there is still a baseline of disaster: countries that are falling further behind the rest. Meanwhile, China and India are moving up so fast relative to us that, between countries, the gaps are narrowing. That is an inevitable result of the fact that Asian countries finally got their acts together, historically. That part of globalization is good, and nothing we caused or could do much of anything about. China is just finally doing things correctly. We wouldn’t wish them poverty, but internationally, they are getting closer to us. Within countries, social divisions are getting greater and greater.

Comstock’s: Our recent real estate bubble has been devastating, but there have been so many bubbles throughout history. Can we accurately, realistically predict these bubbles? Are there consistent clues?

Lindert: First, let’s have an initial clarification: not all financial booms and crashes are bubbles. Economists define a bubble as a collective blunder in which people bid up an asset’s value simply because they saw it rising already. We also have financial booms and crashes for reasons other than bubbles. Sometimes they happen because people react objectively to surprising news. Sometimes they are invited by policy errors rather than investors’ own errors.

All that said, there are clues, if you know what’s going on. The difficulty with the real estate bubble was we didn’t know what they were doing, which was very opaque. There were only a couple of regulators within the government back at the end of the Clinton era warning us, and they were dismissed or out-argued. For the rest of us, frankly, it was hard to know what was going on. It was the same with the savings and loan crisis of the ’80s.

But there is a more simple part of the bubble that you could forecast, and I describe it this way: Wait until you hear people saying, “We know it’s going to keep up because it’s been going up.” When you hear that, sell. That’s your sign of a bubble — phrases like “the trend is your friend,” or “this time is different because we’re in a new technological age.” Any time someone says that, you sell. That’s part of the bubble phenomena.

Comstock’s: Is there a way to gauge the relative impact of what we’ve recently experienced compared to previous economic downturns?

Lindert: Since the 1980s, we in the U.S. have had the S&L meltdown, the sudden 28 percent stock dive over the weekend of Oct. 16 to 19, 1987 (“Black Monday”), the stock market bust of 2000, a lesser stock dive in 2008, and the huge housing crash since 2007.

Other countries have had theirs, too. The biggest was in Japan, which has never recovered from its double bubble of stock and housing popping in 1990 to 1991. In real estate, Iceland, Ireland, the UK and Spain have had as big a crash as the U.S. But as a percentage of one year’s GDP, the U.S. housing meltdown since 2007 is the biggest bust of all. The amount of the shock we were given by the malfunctioning financial market is bigger now than any other the United States has experienced, even as a share of GDP.

I was just looking up the numbers again. It is bigger than the stock market crash of 1929 or any other Wall Street crash that we’ve had. The reason why we have not yet had a depression as big as in the 1930s is that our policies are not nearly as bad as those of that time. We have managed to keep the current Great Recession smaller than the Great Depression of the 1930s because the Fed dramatically eased credit and the U.S. government kept the job losses from being as great as in the 1930s. In fact, we’ve never even had another housing crash. This is the first biggie.

Comstock’s: You’ve spoken of the “moral hazard” of not more thoroughly regulating the financial markets. What do you mean?

Lindert: Moral hazard is where a party insulated

from risk behaves differently from how it would behave if it were

fully exposed to the risk.

U.S. policy has invited the systemic disaster of moral hazard by

bailing out crashing gamblers, especially the biggest ones. This

has developed in America in a number of ways. Lousy regulatory

policy, for example, directly made the mortgage crash worse

because we had given too many people too much freedom to play

with other people’s money. We also made the bipartisan mistake of

repealing parts of the 1933 Glass-Steagall Act in 1999, thereby

allowing investment bankers to play with the deposits of ordinary

folk in ordinary banks, with the risk being passed on to the

taxpayers who insured those deposits.

America was over-housed even before 2007, giving too much in tax breaks and subsidies for homeownership. Mortgage debt as a share of one year’s national product was only 13 percent in 1950, but 63 percent by 2004. By itself, that would not make for a crisis, but then Freddie Mac and Fanny Mae ramped up lending too. The current mortgage crash was aided by the now-famous “Greenspan Put” of monetary policy, in which (former Federal Reserve Chairman) Alan Greenspan effectively signaled to the banking sector that the Federal Reserve would give them abundant cheap credit if their gambles went wrong.

Comstock’s: Were we wrong to bail out the biggest players?

Lindert: I cannot say that was a mistake. By 2008, we were trapped. The mistakes had been made earlier.

Comstock’s: It’s hard to escape how dependent everyone else in the world is on the U.S. economy. Can you put in context what a debt default really would have meant to the global economy?

Lindert: A true U.S. debt default, meaning we don’t repay creditors, would be huge. That would be an extremely dark moment in history, not only because of sending the world economy into a deeper depression but also because of seriously disrupting and angering China. They and Japan are the biggest external holders of our debt and the amounts they are holding are as large as a share of our total treasury debt. Not as big as what the Federal Reserve holds, but very big. It would be a very dark time for the Chinese government. They would look at us as scapegoats, and it would be very ugly.

Comstock’s: It sounds like the ramifications for that would be almost unthinkable.

Lindert: Yeah, we don’t want to go there. Thankfully, a majority of those in Congress knew we didn’t want to go there. A majority, not all.

Comstock’s: We’ve talked about bubbles. Is there any sector you’re seeing right now that is giving you some of the warning signs you talked about earlier?

Lindert: The easiest one to pick off is gold. A year from now gold will be lower in price than it is today. Now is it exactly a bubble? Well, probably. There are probably frightened people out there who are saying, ‘It’s going up because it’s going up. It’s going to go up because it did go up.’ That’s the bubble fallacy. Other people frankly are reacting to objective conditions.

People are buying gold in eastern Africa, Pakistan, many other parts of the world because they live in a frightening world, and gold is one of the things you try to hold on to in a frightening world. So there is that hint of objectivity there, but that is still a bubble. Gold, and silver to a lesser extent, are having bubble behavior right now. You can just see the advertisements from self-interested parties selling it saying, “Hey look what’s been happening, don’t you want to get on the bandwagon?” That’s your clue. You better sell. You better stay away from this stuff.

Recommended For You

On the Hunt

Searching for economic prosperity in untapped talents

Sacramento loves regional planning. Take an issue — say, transportation or land use or coordination of local government — and a group will sprout to chart a course.

Eye On the Prize

Acuity with Bill Mueller

Bill Mueller, 47, is CEO and managing partner at Valley Vision. One of four partners in the regional Next Economy initiative, Valley Vision serves as the project manager of the Capital Region’s latest economic development effort.