More and more Americans are waiting until the very last minute to do their taxes.

Last year’s end-of-season rush was intense. The Internal Revenue Service collected 29 million individual returns between April 8 and April 22. That’s one-fifth of all those filed in 2016, a 24 percent surge in late-season filings from the previous year.

Taxpayers have a few extra days to procrastinate: While the traditional deadline is April 15, returns this year are due Tuesday, April 18.

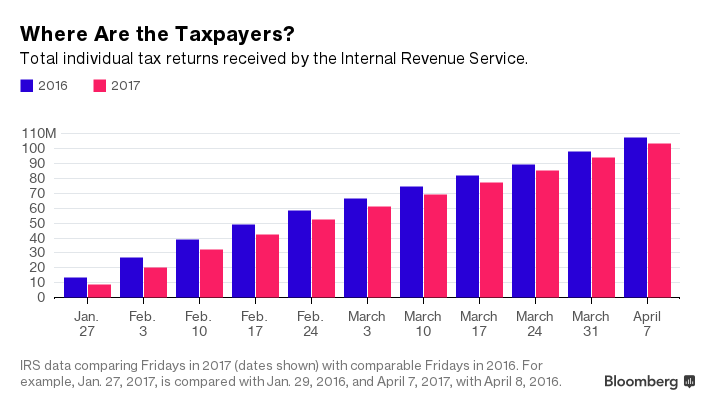

And Americans were already behind schedule, according to the IRS. The season got off to an especially slow start partly due to a new law that delayed refunds for some filers. The gap has narrowed somewhat, but as of April 7 almost 4 million fewer people had filed than at the same point a year ago.

One culprit is online tax filing, which makes it easier to put it off. In past decades, post offices would be mobbed with long lines on the night of the deadline. Tax day parties would even break out.

But as more people file electronically, it’s easier to wait until the last minute without the hassle of waiting in line. Online tax programs also mean you don’t have to make an appointment in advance with an accountant or some other tax preparation service.

“You can just sit in your pajamas or your underwear and use TurboTax,” Brad Smith, chief executive of parent company Intuit, said in a recent interview with Bloomberg News. “You just hit send by 11:59 p.m. and you’re good.”

Still, all that last-minute filing puts a strain on prep companies, their employees and computer systems. Credit Karma, the credit monitoring platform, launched a free tax preparation product this year. A big challenge, according to CEO Kenneth Lin, is predicting what end-of-the-season demand would look like. “We don’t know,” Lin said last month. “We over-invested in anticipation,” hiring extra workers and preparing the site’s technology for a surge in traffic.

At TurboTax, the end of season is an “all hands on deck” situation, according to Intuit spokeswoman Julie Miller. Senior Intuit executives, including CEO Smith, spend the last few days of tax season at TurboTax’s call center in Tucson, helping take customer calls.

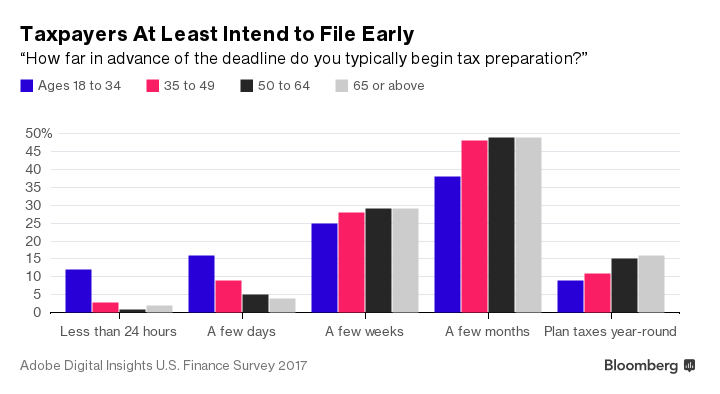

If you owe the IRS money, it might make sense to wait as long as possible to file your return. But most of us have every intention of filing earlier. The majority of taxpayers say they start preparing for tax season at least a “few months” before the deadline, according to a survey of 1,000 consumers last month by Adobe Digital Insights.

Millennials, who tend to have the simplest tax situations, are the likeliest to wait until the last moment: 12 percent of 18-to-34 year olds say they wait until the last 24 hours to think about filing, the survey found. Another 16 percent say they only start “a few days” before the deadline.

Millions of people, however, end up missing the deadline entirely. The IRS automatically grants taxpayers an extension, to the middle of October — if they ask for one. There are strings attached, though: The extension only applies to the filing of the tax return. You still need to pay any money you owe by April 18.

Many taxpayers have no choice but to file for an extension, especially if they’re wealthy and have complicated financial situations. Hedge funds, partnerships, and other investment vehicles can generate tax forms that don’t arrive until summer, or even autumn.

Then there are the people who don’t ever file. The self-employed are less likely to file than average Americans, while younger people are less likely to file than those over 65. Some who choose not to are within their rights: If you have a very low income, you probably don’t need to file. But in the end, you probably want to anyway — that way, you get any tax refund you have coming and qualify for tax credits.

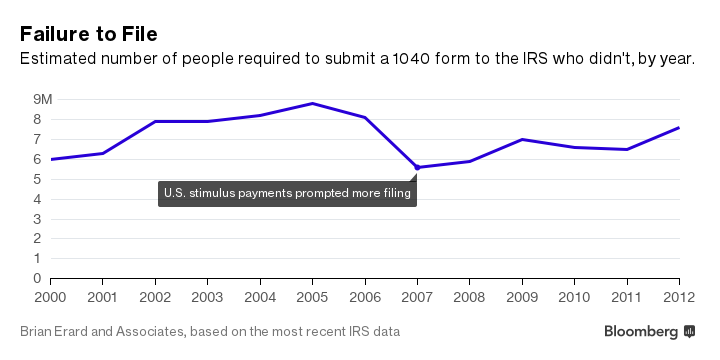

Finally, there are the outlaws. About 6 percent of U.S. taxpayers are breaking the law by not filing, according to an analysis by economic consultant Brian Erard. Based on the most recently available IRS data, Erard calculates 7.6 million returns should have been filed in 2012 but weren’t.

It’s generally not a good idea to stiff the IRS. Billions of tax records, including W-2 and 1099 forms, get sent each year to the IRS, where computers analyze them, looking for missing taxpayers and unreported income. If you have any kind of paper trail, expect the IRS to find you eventually.

Sure, it’s a remote possibility, but taxes are indeed the rare case where procrastination can land you in prison.