The Four Commandments of the Good-Jobs Strategy

How well-paying businesses make it work on the floor and at the bank

Judging by prevailing retail practices, somewhere etched in stone is this edict: “To slay thy competition thou shalt undercut on labor costs.”

But a few apostate companies have strayed from that decree by offering decent wages, good benefits and predictable work schedules. Shockingly, the wayward are prospering.

Will Increasing Minimum Wage Thwart Farm to Fork?

Sacramento’s success depends on opportunity

Sacramento is driving the farm-to-fork movement nationwide. These efforts are led by small, local owners with community-minded restaurants. Our ability to grow this movement could be put at risk if the minimum wage is not approached in a thoughtful way.

Governing in the Digital Age

California State Assemblyman Matt Dababneh talks tech and the need to improve financial literacy for all

At 34, Assemblymember Matt Dababneh is one of the youngest members of the California Legislature. During his short stint in the Assembly, Dababneh has forged a reputation as a tech-savvy, pro-business lawmaker and earned himself the chairmanship of the Assembly Banking and Finance Committee. We sat down with him recently to talk about a few of his key agenda items.

4 Tips for Profitable Management

Save money with better systems

Large retail chains like Costco, Trader Joe’s, QuikTrip and Mercadona pay wages and benefits considered high for their industries. They also use four key operational strategies:

Be Careful How You Classify

How to avoid wage litigation in the age of the $10 hour

For California labor lawyers, the 2012 Brinker v. Superior Court ruling was something akin to Brown v. Board or Roe v. Wade. In a case involving meal and rest breaks for hourly employees, the court ruled that businesses must have a policy giving workers those breaks — but they don’t have to ensure that staff actually take them. It seemed like near-total victory for business.

Minimum Wage: In Support of the Working Poor

Letting the minimum wage remain stagnate is inhumane and bad for our communities

When the economy serves people by allowing them to earn money, they can invest money back into the economy, thereby increasing economic health for everyone. We want an economy where full-time workers are self-sufficient and not dependent on government aid to supplement their wages. We want an economy that works for us. But here is a glimpse of our reality:

Minimum Wage: In Support of Struggling Businesses

Sacramento’s economy cannot support a Los Angeles-sized solution

Calls for a minimum wage increase are growing louder, and these proposals are neither minor nor manageable for the city of Sacramento. Sacramento’s city-specific hike proposals range from $13.50 to as much as $15 per hour.

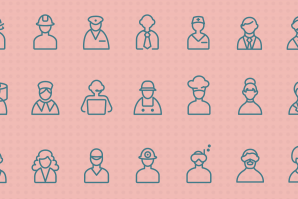

Portrait of a Wage

The what, where and who of making minimum wage

Where are minimum wages higher? Who makes minimum wage, and who supports raising it?

The Great Bank Shakeout

Community banks failures offer an opening to the small lenders that survive

With about 10 percent of total banking assets, community banks are the source of almost half the nation’s small-business loans and 43 percent of its farm loans. New regulations and low interest rates have shut down many smaller banks or forced mergers, but the survivors say they’re poised to take advantage of market openings and an improving economy.

Strategic Thinking for the Future of Higher Ed

Acuity with Steven Currall

Steven Currall is the Chancellor’s Senior Advisor for Strategic Projects and Initiatives and a management professor at UC Davis, where he is leading campus-wide deliberations about the vision for the university’s long-term future.