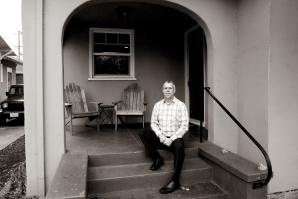

Ted White has worked in residential property management in the Sacramento area for more than three decades. He gloried in the boom times and helped homeowners and investors slog through the murky waters of the ongoing real estate meltdown in one of the hardest-hit housing markets in the nation.

“The strange thing about property management is that it tends to do well in a downturn,” says White, president of Sacramento Delta Property Management. “Our industry began during the Depression.”

With a glut of foreclosures in the Sacramento housing market, White says he’s seen all manner of challenges for homeowners renting out a property they might otherwise prefer to sell.

“There is a pretty big group of people in that category and always has been to some extent,” he says. In today’s market, “they are not living in the home themselves or are moving out of the area and can’t sell it for what they purchased it for.” Frequently, they are dealing with an underwater mortgage.

And there are those who “have rented to a friend or co-worker and didn’t really screen the tenants, and ended up having to evict. That’s when they contact us.”

While foreclosures “used to be the kiss of death” on a rental application, White says, “we now accept people who have a foreclosure on their credit report as tenants. We look at it as one item in the rest of their credit reports. Our job is to look closely at their history.

They should be able to pay for the property, with income that is three times the rent. They need a mostly good credit report (and) rental references.” They may have owned a home sold in a short sale, which White says is increasingly common in tenant applications.

White says property managers generally charge either a flat monthly fee or a percentage of rent collected to handle the various details of renting and maintaining a property. Separate from the management fee, he adds, is a rental fee that ranges from about half to all of one month’s rent. “It’s rare, but we’ve seen families stay in one place for 15 years or longer,” he says.

Major repairs can be a sticky issue with some owners, White says. “Homes and everything in the homes have a finite life,” he says. “They’ll say, ‘Well, it worked fine when I lived there.’ Yes it did, but it’s come to the end of its life. It’s important to have some money set aside (for repairs). You have to think about the investment if you expect to keep the rent coming.”

And, while property managers will “work with clients,” White says, “There is a threshold. If we get to the point of habitability issues, we will have to terminate the contract.”

He says the proverbial “tenants from hell” are, mercifully, “a small percentage” of renters, especially if they have been thoroughly screened by management firms. “By and large, the residents want to cooperate. They want us to be responsive, and they want things to be working. It can be a challenge if the owner doesn’t think the (repair) requests are serious enough. We have to provide good customer service to the renters, and we want them happy.”

Dealing with complaints “and comments” from neighbors presents other challenges, White says. “Some are reasonable, some are not.” One person’s perception of loud music may be another’s musical enjoyment, and noise is more often an issue in multifamily rentals. “Our philosophy is that we want the neighbors to know who is managing the property. We want to be sure they have numbers to call.”

Recommended For You

The Accidental Landlord

More homeowners are turning to the rental market for mercy

Brian O’Hearn is an accidental landlord.

Like more and more homeowners caught in the descending mortgage spiral, O’Hearn and his wife, Juliet Williams, faced tough choices. Married in June, they owned his house in Folsom and her Sacramento condo — and both wanted to live in midtown.

Rent the American Dream

Sacramento millennials aren't interested in mortgages

Brian Collins is a 26-year-old director of accounts at Sacramento-based mobile applications marketing firm Appency. He makes what he calls “decent money,” is putting lots of it into a 401(k) and has an eye on his financial future. And, like most people his age, he’s decided that buying a house is not part of the plan.