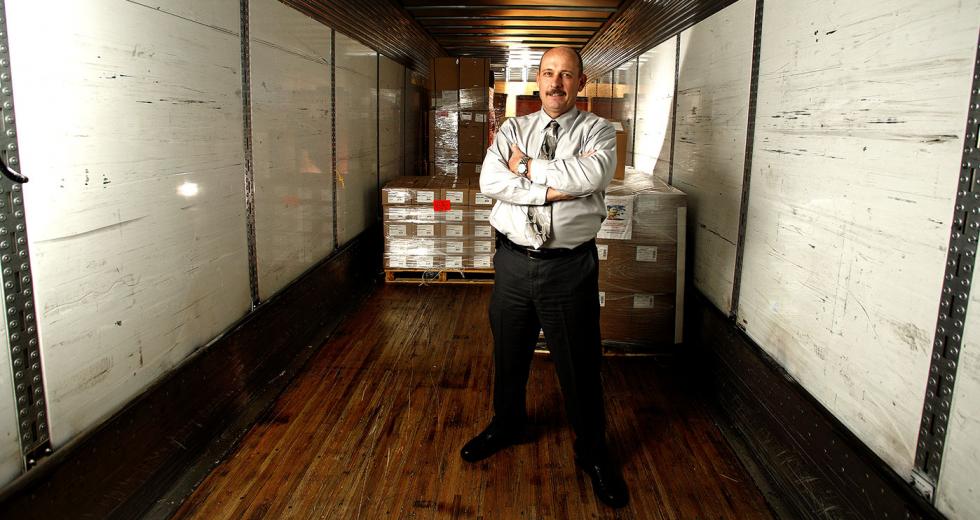

In a year of job loss and company closures, Scott Blevins’ freight business is expanding, hiring and hauling in the cash.

Mountain Valley Express, a less-than-truckload transport company, has been moving general commodities across the state since 1976. For years the company has been serving the Capital Region from its Manteca headquarters, but last year Blevins selected West Sacramento as the location for a new terminal with 20 trucks and 36 employees.

“West Sacramento made sense because of its proximity to the (interstates) 80 and 5. We connect with our Pacific Northwest partner everyday in Redding, so proximity to the corridors is a plus,” he says. “We’ve found it to be very business friendly and trucking compatible.”

Mountain Valley Express needed a new terminal — West Sacramento makes nine total for the company — in order to cope with the growth its experienced in the past three years.

When Blevins took over the company in 2003, it was running 130 trucks and grossing $25 million. By 2010, the business was grossing $36 million.

But that growth hasn’t come without some serious pitfalls.

For the past 25 years New United Motor Manufacturing Inc. has been Mountain Valley’s largest single account, valued at about $7 million in annual contracts. That historic company shut down its Fremont plant last March, “and we were wondering what the heck we were going to do,” Blevins says.

Within days of the auto plant closure, Blevins received a call from The Reliance Network, a group of six regional less-than-truckload carriers providing cross-continent service in North America. They needed a new provider in the Northwest.

Meanwhile, two of Mountain Valley’s largest competitors exited the market as the result of the recession.

Blevins says the serendipitous chain of events “was a blessing from above.”

Contracts through The Reliance Network completely replaced the revenue that would have been lost through the Nummi closure, and now Mountain Valley is looking to gross $40 million this year, build another new terminal (possibly in Tucson) and launch a new division for supply chain solutions.

“We’re seeing our volumes sustain themselves,” Blevins says. “We actually had our busiest day ever — 1,650 shipments companywide — the day before Thanksgiving, when, traditionally, we see a slowdown during the holidays.” On an average day, the company handles about 500 unique shipments.

Still Blevins says he is watching the company’s balance sheet carefully. New state and federal trucking regulations plus unfavorable changes to portions of the tax code spell uncertainty for the financial future. Mandated fleet replacements and upgrades are estimated to cost the company about $8 million over the next three years.

In addition, Freight Transportation Research Associates, which forecasts and analyzes the trucking industry, is projecting an unfavorable shipping environment in 2011, “due to tightening carrier capacity as the economy re-accelerates and new federal trucking regulations take hold.”

Blevins picked up a healthy chunk of market share when his two largest competitors exited the market, but he says he is still up against big market challengers UPS Freight and FedEx Freight. Those two players are certainly not taking these market changes lightly.

In January, FedEx announced the launch of its revamped less-than-truckload operation, which will use freight rail to support its new “economy” service, according to President and CEO William Logue. Historically, Fed-Ex has used rail transport sparingly, while UPS has long been the country’s largest single-company user of intermodal services.

By using rail, FedEx can consolidate the handling of its economy and priority shipments into fewer facilities, saving money.

Unable to bat against the heavy hitters, Blevins says his company is focused on providing customers with quality, personalized service.

“We do a lot of things they can’t because we’re flexible,” he says.

In addition, Blevins is attempting to expand his customer base by launching a supply chain solutions division out of the company’s Visalia terminal.

“We turn business away every day from customers asking for services above and beyond less-than-truckload,” he says. “With the supply chain solutions division, we want to offer a solution to those needs. It doesn’t mean we can run those solutions on our own trucks, but we can partner with companies that do.”

Recommended For You

$30 Million Gamble

Port expansion project has uncertain future

The ports of West Sacramento and Stockton are betting that a $30 million public investment in new infrastructure will convince local importers and exporters to transfer their method of goods movement to the San Francisco Bay from trucking to barge shipping.

The Truck Stops Here

18-wheelers sacked by clean air cops

There is a squad of clean air cops in Sacramento with a

strong-arm approach that squashes the stereotype that

environmentalists are wimps. These officials make up the

enforcement branch of the California Air Resources Board, and

they face off against truckers still fuming over

emission-control rules they fear will put them out of business.